EXPERT FINANCIAL SERVICES

Life Doesn't Freeze, And Neither Should Your Wealth.

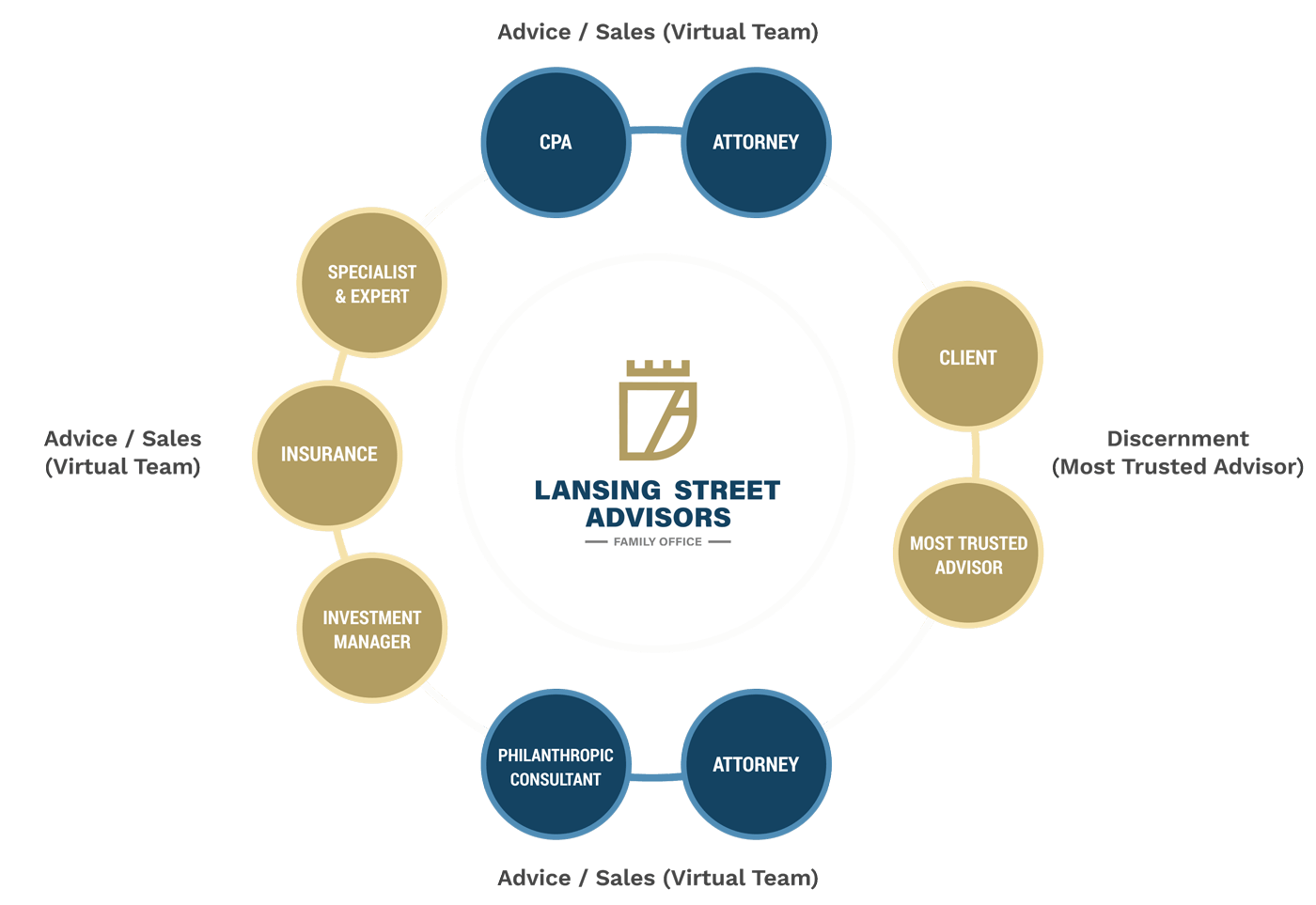

At Lansing Street Advisors, we view wealth as not just money but a complete portfolio of strategies and opportunities to broaden growth possibilities. Combining proven programs to diversify and strengthen wealth while maintaining or improving cash flow, we take a holistic, top-to-bottom representation of your finances, taxes, cash flow, investments, and lifestyle to customize a one-of-a-kind plan tailored to your goals.

Our Four Pillars Of Financial Success

Wealth Enhancement

It focuses on the many approaches that families can use to protect and maintain wealth. Tax mitigation and cash flow planning are but a few ways to manage cash flow and yet maintain a fulfilling lifestyle.

Wealth Transfer

It transfers wealth or assets to heirs through financial planning strategies that often include estate planning, life insurance, wills, or trusts in a tax-efficient way to capitalize on the most efficient means possible.

Wealth Protection

Safeguarding wealth against volatile markets or terrible investment decisions through estate planning, trusts, insurance policies, and more helps keep wealth safe and secure for current and future generations.

Investment Consulting

Investments come in various forms. From stocks and mutual funds to real estate and IRAs, Lansing Street Advisors takes your current financial portfolio and wealth attainment goals to form a comprehensive plan so that your wealth stays safe yet increases at a rate designed with your future in mind.

BROWSE OUR WEBSITE

CONTACT INFORMATION

Email: info@lansingadv.com

BUSINESS HOURS

- Mon - Fri

- -

- Sat - Sun

- Closed

OUR LOCATION

124 S. Maple Street, Suite 325 Ambler, PA 19002